EIA Reports -177 Bcf Withdrawal From Storage for Week Ended Dec. 5

The January NYMEX contract is trading near $4.22/MMBtu after a soft storage day, sliding from yesterday’s $4.60 close. Prices were hovering around $4.39 ahead of the EIA release, dropped to roughly $4.30 on the print, and have continued to drift lower as the market gives back more of last week’s weather-led spike. Forecast revisions remain the main driver as recent runs have trimmed the severity of the upcoming cold. Today’s fundamental balances still lean winter-tight: production is hovering at 107.7 Bcf/d with Canadian imports at 6.9 Bcf/d, putting total US supply at 114.7 Bcf/d. ResComm demand has rebounded to 47.3 Bcf/d as colder air rotates back across the North and East, while LNG feedgas holds near 18.5 Bcf/d and keeps export pull strong, with total demand around 144 Bcf/d.

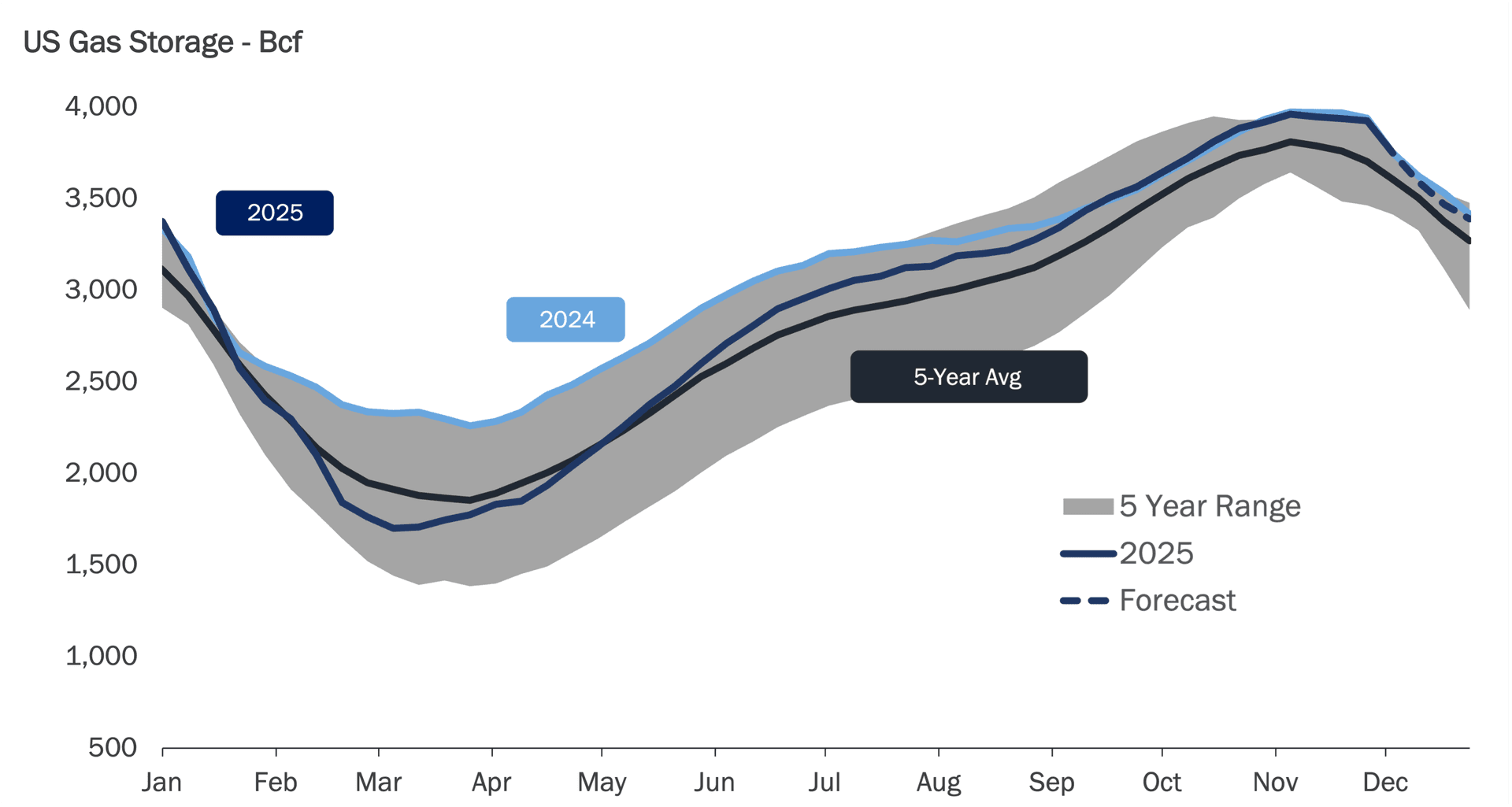

The EIA reported working gas at 3,746 Bcf for the week ended Dec. 5, a hefty 177 Bcf withdrawal that was roughly double the five-year average pull near 89 Bcf and slightly larger than the 167 Bcf draw in the same week last year. Regionally the East drew 45 Bcf, the Midwest 58 Bcf, the Mountain 11 Bcf, the Pacific 9 Bcf, and the South Central 55 Bcf (Salt 17 Bcf, nonsalt 38 Bcf). At 3.746 Tcf, inventories now sit about 103 Bcf (≈2.8%) above the five-year norm of 3.643 Tcf and 28 Bcf (≈0.7%) below last year’s level, tightening both the surplus and the year-on-year deficit. On the LNG front, Venture Global’s legal fight with foundation customer Shell over Calcasieu Pass moved to a New York court, where the exporter is asking a judge to uphold an arbitration win and dismiss Shell’s fraud allegations. The outcome won’t change near-term balances, but the growing stack of arbitration cases around commissioning cargoes and contract start dates is an important backdrop for how future US LNG offtake deals are structured and how counterparties price long-term contract risk.

NYMEX Natural Gas January Contract Trading at $4.22/MMBtu

Petrobras Strike Vote Keeps Labor Risk on Radar

Front-month WTI trades near $57.24/bbl this morning, down from yesterday’s $58.46 close, as the complex digests softer macro sentiment while keeping an eye on Brazil-related headlines. Unions representing workers at Petrobras have rejected the latest pay offer and are planning an open-ended nationwide strike starting Dec. 15, covering roughly three-quarters of the broader workforce across company and contractor roles. The last major walkout in 2020 had only a limited impact on subsalt output because many FPSOs were leased and operated by third parties, and officials again expect offshore production to be largely insulated this time. The bigger swing factor is refining and onshore logistics, where work-to-rule tactics and disruptions around shift changes could temporarily pinch products supply if the standoff drags on. For now, the market is treating the action as a localized labor dispute rather than a major supply shock, keeping Brent and WTI anchored mostly by global demand worries and broader risk sentiment rather than Brazil alone.

Keep Reading

More from Gelber & Associates

PetroReconcavo Nudges Brazilian Onshore Output Higher

January NYMEX is trading near $4.93/MMBtu this morning, down a fair margin from Friday’s $5.23 close as futures give back part of their hefty weather-driven gains.

Agbami Maintenance Tightens Nigerian Light Sweet Supply

Big moves today in the gas markets as January NYMEX is trading near $5.45/MMBtu this morning, surging from yesterday’s $5.06 close and marking the highest prompt-month print since 2022.